Industry-leading loan origination software.

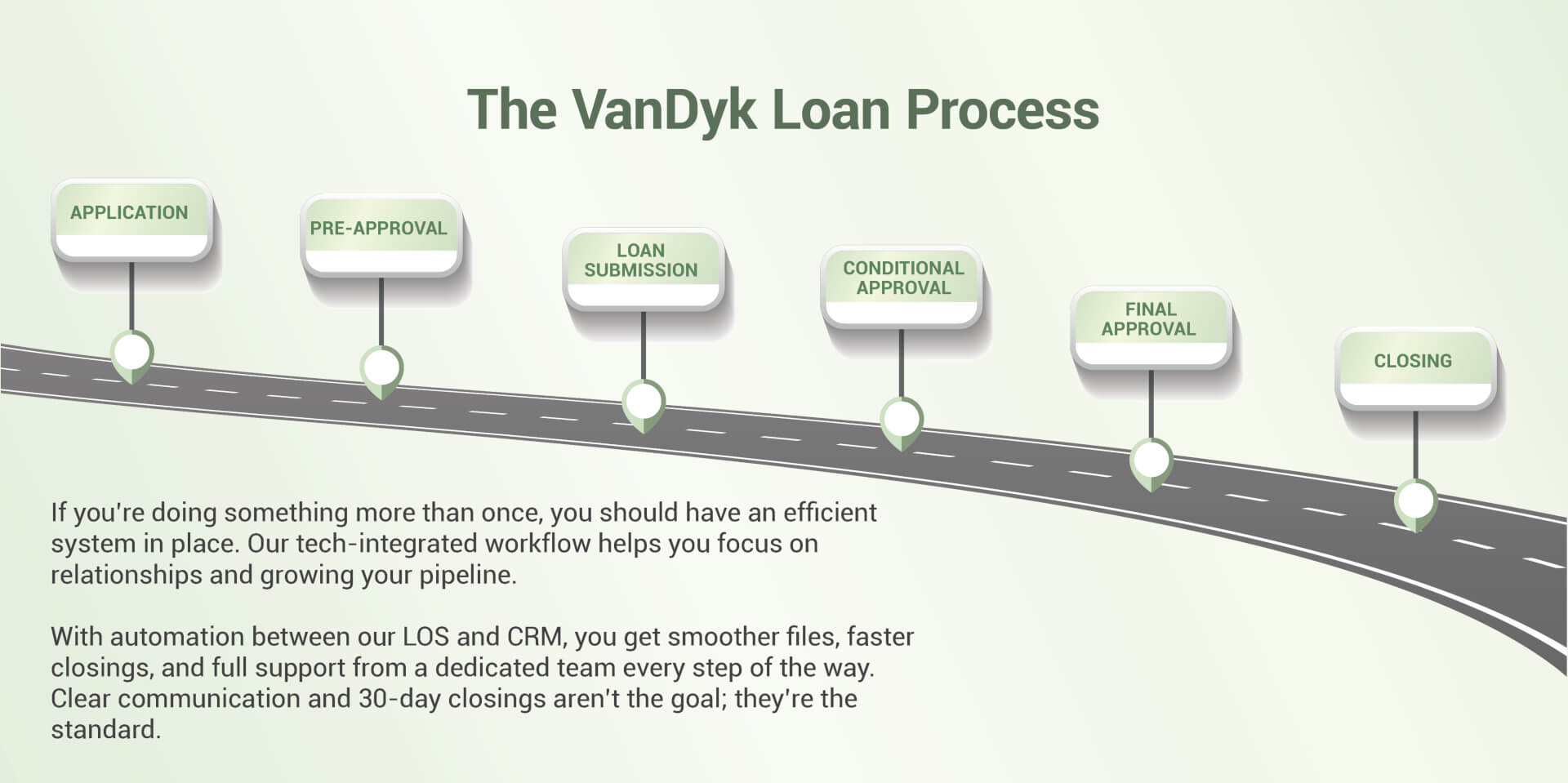

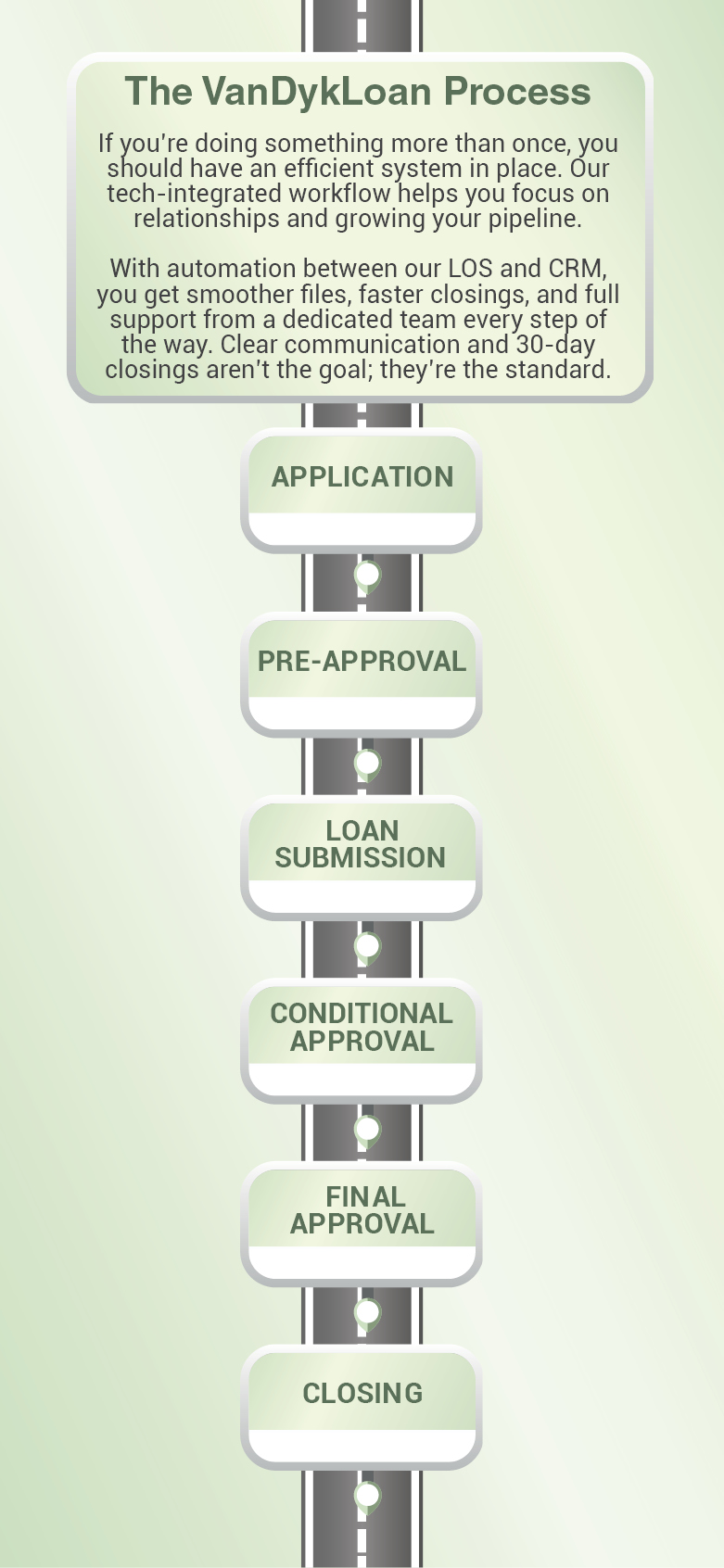

Streamlined loan application and document collection that integrates with our processing system.

Technology leader that empowers Loan Officers with tools to price, reprice, lock, relock, and extend.

Business reviews management platform to collect and share reviews all while improving your local SEO and driving reviews to Google.